Content

- How to Calculate Bad Debt Expense

- What Is a Bad Debt Expense?

- Allowance for Doubtful Accounts Journal Entry Example

- Difference Between Bad Debt and Doubtful Debt

- Fundamentals of Bad Debt Expenses and Allowances for Doubtful Accounts

- Stay up to date on the latest accounting tips and training

- Interested in automating the way you get paid? GoCardless can help

A reserve for doubtful debts can not only help offset the loss you incur from bad debts, but it also can give you valuable insight over time. For example, your ADA could show you how effectively your company is managing credit it extends to customers. It can also show you where you may need to make necessary adjustments (e.g., change who you extend credit to). • A doubtful debt, as its name suggests, is an accounts receivable that the business is not sure whether it will receive.

- However, while the direct write-off method records the exact amount of uncollectible accounts, it fails to uphold the matching principle used in accrual accounting and generally accepted accounting principles .

- This brings your total for those two groups to a doubtful account allowances of $2,125.

- In this post, we’ll define bad debt and impairment to give you a clear idea of what the terms entail and how they can affect your business.

- The the amount that a company keeps as bad debt reserve is determined by the company’s management and the nature of the industry.

- For example, a category might consist of accounts receivable that is 1–30 days past due and is assigned an uncollectible percentage of 3%.

- Business bad debts are debts closely related to your business or trade.

- Thus, virtually all of the remaining bad debt expense material discussed here will be based on an allowance method that uses accrual accounting, the matching principle, and the revenue recognition rules under GAAP.

However, the excess is to be written off from that particular year’s profit & loss account. Bad Debt is a debt of which nothing can be recovered, and it is written-off as uncollectible in the books of account. On the other hand, doubtful debt is just an estimation of the amount whose collection is unsure and may turn out as bad debt in the future. When a specific debtor defaults in the payment of the amount due from him, it amounts to bad debt. As against, when there is uncertainty as to the recovery of the amount due from various debtors, it is termed as doubtful debts. While bad debts represent actual loss, doubtful debts represent anticipated loss. This is due to the fact that doubtful debts have the probability of turning out as uncollectible in the future, but in the case of bad debt, they are clearly recognized as uncollectible.

How to Calculate Bad Debt Expense

The companies that qualify for this exemption, however, are typically small and not major participants in the credit market. Thus, virtually all of the remaining bad debt expense material discussed here will be based on an allowance method that uses accrual accounting, the matching principle, and the revenue recognition rules under GAAP. This involves estimating uncollectible balances using one of two methods.

What does bad debt mean?

Bad debt refers to loans or outstanding balances owed that are no longer deemed recoverable and must be written off. Incurring bad debt is part of the cost of doing business with customers, as there is always some default risk that is associated with extending credit.

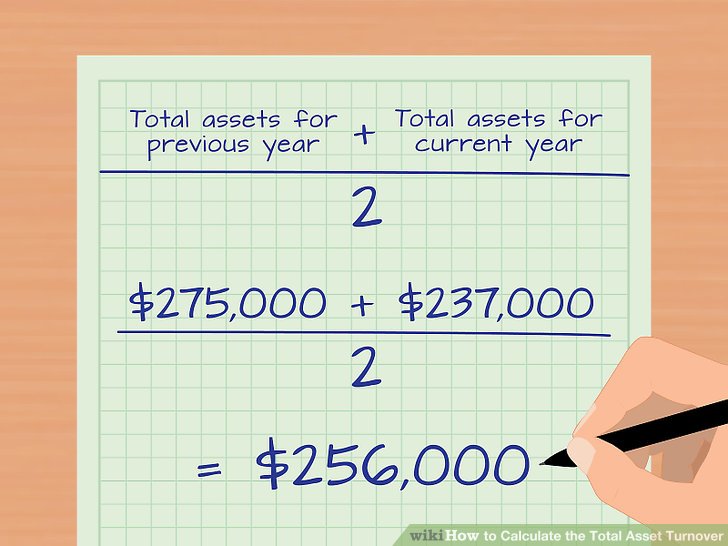

The percentage of receivables approach is another simple approach for calculating bad debt, but it too does not consider how long a debt has been outstanding and the role that plays in debt recovery. The estimated percentages are then multiplied by the total amount of receivables in that date range and added together to determine the amount of bad debt expense.

What Is a Bad Debt Expense?

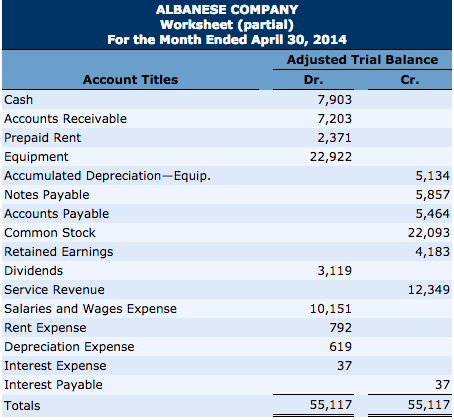

In accrual-basis accounting, recording the allowance for doubtful accounts at the same time as the sale improves the accuracy of financial reports. The projected bad debt expense is properly matched against the related sale, thereby providing a more accurate view of revenue and expenses for a specific period of time. In addition, this accounting process prevents the large swings in operating results when uncollectible accounts are https://online-accounting.net/ written off directly as bad debt expenses. Then all of the category estimates are added together to get one total estimated uncollectible balance for the period. The entry for bad debt would be as follows, if there was no carryover balance from the prior period. The allowance for doubtful accounts helps report the bad debt expense as soon as the estimate is calculated and portrays a more accurate view of the financial statements.

The accounting entry will require a debit to be made in the provision for loss account and a credit entry to be made in the provision for doubtful debts account. Once this entry is completed the provision will be recorded in the balance sheet by deducting that amount from the debtors. Depending on the probability of bad debts, the provision for doubtful debt account maybe increased or decreased. A bad debt is referred to as an amount that most certainly will not be received by the business. These amounts are accounts receivable that have been recorded in the books for a long period of time, , and no efforts have been made by the debtor to make repayments.

Allowance for Doubtful Accounts Journal Entry Example

A doubtful debt is an account receivable that might become a bad debt at some point in the future. You may not even be able to specifically identify which open invoice to a customer might be so classified. Bad debt is an account receivable that has been clearly identified as not being collectible. Doubtful debt is an account receivable that might The difference between bad debt and doubtful debt become a bad debt at some point in the future. One common way to estimate how much your allowance for doubtful accounts should be is to rely on historical data. If your business was steady in the year prior and you do not anticipate significant changes to your business in the upcoming months, this is a simple and fast way to look at it.

This undervalued company is only masquerading as unloved stock – msnNOW

This undervalued company is only masquerading as unloved stock.

Posted: Tue, 31 Jan 2023 06:00:00 GMT [source]

It also happens when a debtor is declared insolvent by the Court or when a consumer is found dishonest and has no intention of repaying a debt for goods obtained on credit. The balance sheet presents your company’s assets, liabilities, and equity. An allowance for doubtful accounts reduces your reported amount of accounts receivables. When the balance on allowance for doubtful accounts is credited, the bad debt expenses are debited. On the other hand, allowance for doubtful accounts is an estimation of the AR that a business expects to go unpaid. It is deducted from the total AR of a company even before a customer defaults. Sometimes the collections team might do an excellent job, and bad debt will be much lower, while at other times, it could be a lot higher.

Difference Between Bad Debt and Doubtful Debt

A company will debit bad debts expense and credit this allowance account. The allowance for doubtful accounts is a contra-asset account that nets against accounts receivable, which means that it reduces the total value of receivables when both balances are listed on the balance sheet. This allowance can accumulate across accounting periods and may be adjusted based on the balance in the account. This expense is called bad debt expenses, and they are generally classified as sales and general administrative expense. Though part of an entry for bad debt expense resides on the balance sheet, bad debt expense is posted to the income statement. Recognizing bad debts leads to an offsetting reduction to accounts receivable on the balance sheet—though businesses retain the right to collect funds should the circumstances change.

Is allowance for doubtful accounts the same as bad debt?

An allowance for doubtful accounts is considered a “contra asset,” because it reduces the amount of an asset, in this case the accounts receivable. The allowance, sometimes called a bad debt reserve, represents management's estimate of the amount of accounts receivable that will not be paid by customers.

Bad debts & doubtful debts are two terms that are often considered synonymous, but there is a fine line between the two. Bad debts refer to the amount of trade receivables that have become uncollectible i.e. they cannot be recovered from the debtors. On the contrary, doubtful debts refer to the amount of trade receivables that are likely to become uncollectible and might eventually become a part of bad debts at some point of time in the future. A bad debt is an account receivable that has been clearly identified as not being collectible. Solution that can facilitate the payment collection process on behalf of your business.

The company would then write off the customer’s account balance of $10,000. To account for the doubtful debt , you create an allowance, which is recorded on your balance sheet. Let’s say company XYZ expects 2% of its payment dues between 0-30 days to turn into bad debt. While, the expected bad debt percentage for invoices that are due for days and days is 5% and 10%, respectively. One example in Financial Accounting centers on a credit provider in India that typically provisions two or three percent higher than the minimum regulatory requirement for Indian companies. The process of strategically estimating bad debt that needs to be written off in the future is called bad debt provision.

- Here’s how to account for doubtful and bad debt on financial statements, along with a primer on bad debt provision and why it’s important today.

- When the customer fails to repay, the amount they owe is deemed uncollectible and is recorded as a charge off.

- Sometimes, a portion of debts in any of the previous accounting years may be recovered in a future accounting period and is called bad debts recovered.

- Under the direct write-off method, 100% of the expense would be recognized not only during a period that can’t be predicted but also not during the period of the sale.

Let’s consider a situation where BWW had a $20,000 debit balance from the previous period. For the taxpayer, this means that if a company sells an item on credit in October 2018 and determines that it is uncollectible in June 2019, it must show the effects of the bad debt when it files its 2019 tax return. This application probably violates the matching principle, but if the IRS did not have this policy, there would typically be a significant amount of manipulation on company tax returns. For example, if the company wanted the deduction for the write-off in 2018, it might claim that it was actually uncollectible in 2018, instead of in 2019. If the doubtful debt turns into a bad debt, record it as an expense on your income statement. Use an allowance for doubtful accounts entry when you extend credit to customers.